islington starbucks ukuncut actions yesterday - report & pics 1 of 2

rikki | 09.12.2012 12:57 | Public sector cuts

---

the first action in islington yesterday took place at the starbucks branch opposite angel tube.

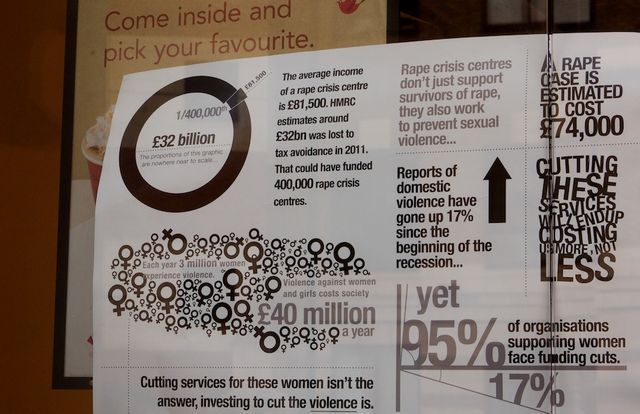

this protest focussed on highlighting the closure of rape crisis centres under the government 'austerity' drive, and to compare the costs of maintaining the service against the loss of government funds due to tax avoidance.

up to ten people including a legal observer managed to enter the coffee shop and set up a mock rape crisis centre at the rear of the branch, with leaflets, an infographic wall chart, and animated discussion.

meanwhile at midday outside, banners and placards were paraded by initially around twenty protestors, but these numbers swelled over the next hour to around forty or fifty people.

the shop staff stopped serving, and the business was effectively closed down for a full hour on a busy saturday lunchtime, while outside, a megaphone provided the forum for us to hear short speeches and information from various women's groups, disabled activists, council workers and other individuals.

the multi-national corporation, rather than paying for any private security, despite reporting £400m sales in the UK last year, chose to rely on tax-funded uk police, who turned up and discussed the situation with the shop manager and activists. turning away from the heavy-handed and even unlawful response to past ukuncut actions, the police were on this occasion less confrontational, and ensuring a path for pedestrians to safely pass by the protest, they facilitated the action calmly.

shortly before one 'o' clock, the remaining protestors emerged from the store to loud cheers, and after a final photo-call, the crowd dispersed.

rikki

e-mail:

rikkiindymedia[At]gmail(d0t)com

e-mail:

rikkiindymedia[At]gmail(d0t)com

Comments

Hide the following 3 comments

The reality of the situation (with multinational corporations)

09.12.2012 14:14

In this case we are talking about Starbucks, a primarily US company. Now the US will allow Starbucks to deduct from its American taxes on the parent company the taxes paid by its British subsidiary on British operations (as these reduced the profits coming home from that subsidiary). Or it could choose, by having high license fees, etc. paid by its British subsidiary to reduce what it pays in Britain but ending up paying more here. I am oversimplifying this, more than two countries can be involved in a chain of transferring expenses and profits, but ultimately that's what we have, you vs us (in the case of Starbucks).

So lets get this straight. You think you should protest Starbucks choosing to pay less in Britain and more here? If Starbucks chose instead to pay more in Britain (and therefor less here) don't you think WE would have the same complaint? That Starbucks was avoiding US taxes by paying more taxes in Britain and thus having a larger deduction against its US taxes.

It's the complexity and differences between the tax laws of different countries that may make it advantagous for a multinational to pay its taxes in one place rather than another or to convert profits from income (operations) into capital gains (which might be taxed differently).

MDN

@ MDN

09.12.2012 21:25

*

DNA

And the profits made THERE flow to .......

10.12.2012 15:09

ULTIMATELY the gains from reducing taxes paid in Britain by reducing the profits of the British subsidiary in favor of the Dutch subsidiary get to the American parent. Use your noggin. If the gains never got home to the parent why would they bother with having these subsidiaries at all?

BUT, if you can't see beyond two countries, try this. Wouldn't your equivalents in Holland object to the Dutch subsidiary receiving less of the profits (so they could be taxed in Britain) want to protest that Starbucks, by doing it that way (having more of the profit being taxed in Britain instead of in Holland) want to protest the ducking of THEIR taxes? If there aren't taxes on this in Holland or a lower rate what that does is raise the value of the Dutch subsidiary; maybe Starbucks US plans to bring that home by selling off the Dutch subsidiary making a big "capital gain" (maybe taxed in the US at a lower rate than ordinary income). Instead of selling it off, they might "spin it off" to their Starbucks USA shareholders.

I'm simply pointing out how they play the game. Our corporate masters playing us off against each other. I do understand why you would want to maximize the taxes paid in Britain, that's YOUR self interest. But you need to understand that from the point of view of MY self interest, better if the taxes ended up being paid here.

MDN